For decades, the bedrock of investment portfolios has been a familiar trio: stocks, bonds, and cash. These traditional assets have served as the cornerstone for generations of wealth builders.

However, in an increasingly complex and interconnected global economy, investors are looking beyond these conventional boundaries.

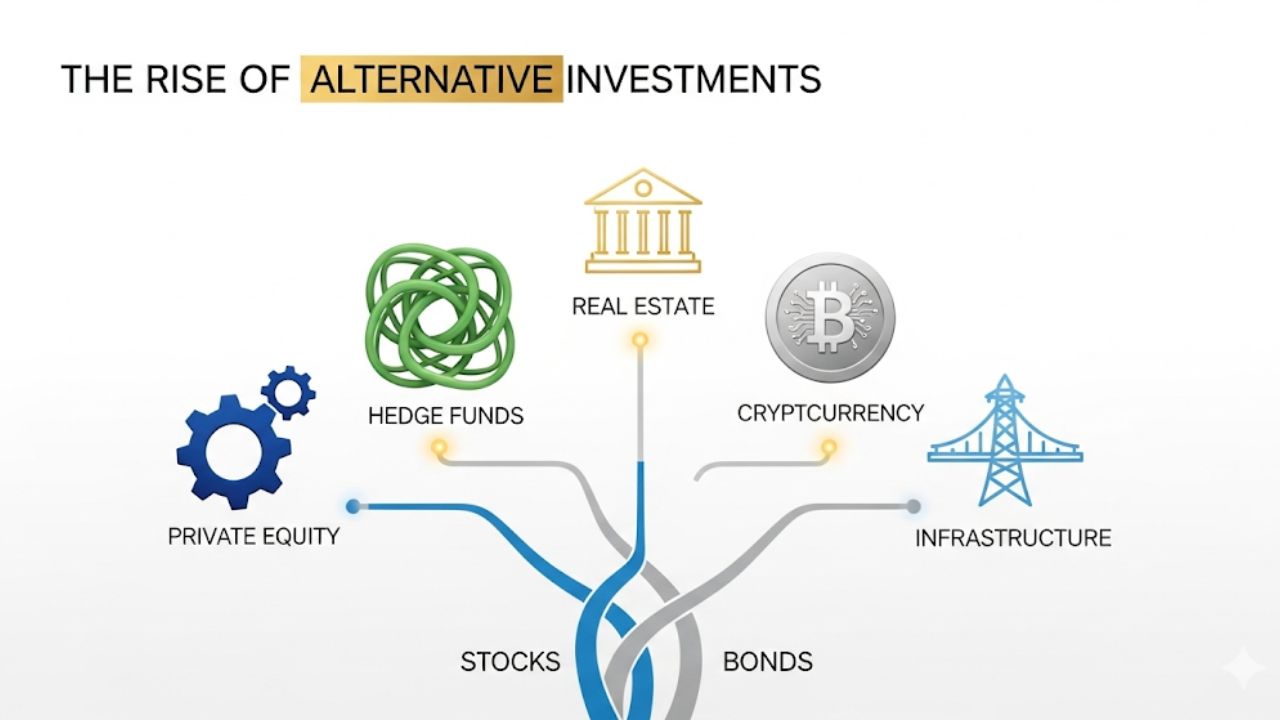

A new landscape is emerging, characterized by the growing prominence of alternative investments – a diverse category of assets that stands apart from the publicly traded stocks and bonds we’ve long known.

The rise of alternative investments isn’t a mere fad; it represents a fundamental shift in how wealth is managed and grown.

Driven by factors such as low-interest-rate environments, the search for diversification, and the democratization of access, alternatives are moving from the exclusive domain of ultra-high-net-worth individuals and institutional funds to become more accessible to accredited and even retail investors.

This article will explore what constitutes alternative investments, the key drivers behind their surge in popularity, and the potential benefits and risks they present to the modern investor.

What Are Alternative Investments?

Simply put, alternative investments are financial assets that do not fall into the traditional categories of stocks, bonds, and cash. They are typically characterized by their unique underlying assets, complex structures, and often, their illiquidity (meaning they cannot be easily bought or sold).

The category of alternatives is vast and ever-expanding, but some of the most common types include:

- Private Equity (PE): Investments in companies that are not publicly traded. This can involve venture capital (funding for start-ups), growth equity (funding for established private companies), or leveraged buyouts (acquiring companies using significant debt).

- Hedge Funds: Privately managed investment funds that employ a wide range of sophisticated strategies, often involving derivatives, leverage, and both long and short positions, to generate returns.

- Real Estate: Beyond publicly traded Real Estate Investment Trusts (REITs), this includes direct ownership of properties (residential, commercial, industrial), real estate development, or private real estate funds.

- Commodities: Raw materials such as gold, silver, oil, natural gas, agricultural products, and industrial metals. Investors gain exposure through futures contracts, physical ownership, or commodity funds.

- Infrastructure: Investments in essential public systems and services, such as roads, bridges, airports, utilities, and communication networks.

- Private Debt: Lending capital to companies or individuals outside of traditional bank loans, often with higher interest rates to compensate for increased risk and illiquidity.

- Collectibles and Fine Art: Tangible assets like rare wines, stamps, coins, classic cars, and artwork, which are valued for their scarcity and aesthetic appeal, and whose value can appreciate over time.

- Cryptocurrencies: Digital or virtual currencies that use cryptography for security and operate independently of a central bank, such as Bitcoin and Ethereum.

Key Drivers Behind the Surge in Alternatives

Several interconnected factors have fueled the growing interest in alternative investments:

1. The Search for Diversification and Non-Correlation

One of the most compelling reasons for alternatives’ rise is their potential to offer diversification and non-correlation with traditional markets. When traditional assets (like stocks and bonds) move in the same direction, a portfolio heavily reliant on them can suffer significant losses during a downturn. Many alternative assets, by contrast, tend to have a low correlation with stock and bond market movements. This means they might perform well even when traditional markets are struggling, acting as a buffer against volatility and potentially enhancing overall portfolio stability.

2. The Quest for Enhanced Returns

In an era of historically low-interest rates and often moderate equity returns, investors are constantly seeking ways to generate higher returns. Many alternative assets, particularly private equity and hedge funds, aim to deliver alpha (returns above a benchmark) through active management, specialized knowledge, and exploitation of market inefficiencies. While these come with increased risk, the allure of higher potential returns is a powerful motivator.

3. Low-Interest-Rate Environment

The sustained period of low-interest rates following the 2008 financial crisis and amplified by subsequent economic challenges has significantly diminished the attractiveness of traditional fixed-income investments like government bonds. With meager yields, investors are compelled to look elsewhere for income and growth, turning to alternatives that offer better income potential or capital appreciation.

4. The “Private Markets” Phenomenon

Many companies are staying private for longer, delaying their initial public offerings (IPOs) or choosing not to go public at all. This means that a significant portion of a company’s growth and value creation happens before it ever hits the public stock market. Investing in private equity or venture capital allows investors to access these growth opportunities that were once only available to early-stage investors or institutional giants.

5. Democratization of Access

Historically, alternative investments were largely the exclusive domain of institutional investors (pension funds, endowments) and ultra-high-net-worth individuals due to high minimum investment requirements, complex structures, and regulatory hurdles.

However, technological advancements, the emergence of crowdfunding platforms, and new regulatory frameworks are slowly democratizing access. Retail investors can now gain exposure to assets like private real estate or private credit through more accessible funds or platforms, albeit often with certain accreditation requirements.

6. Inflation Hedging

Certain alternative assets, particularly commodities and real estate, are often seen as effective hedges against inflation. As the cost of goods and services rises, the value of these real assets can also appreciate, helping to preserve purchasing power and protect portfolios from inflationary pressures.

Benefits and Risks of Alternative Investments

While the appeal of alternatives is strong, it’s crucial to understand both their potential advantages and inherent disadvantages.

Potential Benefits:

- Diversification: Reduced overall portfolio risk due to low correlation with traditional assets.

- Higher Potential Returns: Historically, some alternatives have offered returns exceeding traditional benchmarks, especially in specific market cycles.

- Inflation Hedge: Certain assets (e.g., real estate, commodities) can help protect against inflationary erosion of purchasing power.

- Access to Unique Opportunities: Investing in assets and strategies not available in public markets, tapping into new sources of growth.

- Lower Volatility (for some): Certain illiquid assets may appear less volatile because they are not marked to market daily, though this doesn’t mean they are risk-free.

Inherent Risks:

- Illiquidity: Many alternative investments are difficult to sell quickly, meaning your capital can be tied up for extended periods.

- Complexity and Lack of Transparency: Their structures can be intricate and less transparent than publicly traded assets, making due diligence challenging.

- High Fees: Alternative funds (e.g., hedge funds, private equity) often charge higher management fees and performance fees compared to traditional funds.

- Valuation Challenges: Illiquid assets are harder to value accurately, and their reported values may not always reflect true market conditions.

- Regulatory Scrutiny: Some alternative investments operate under different regulatory frameworks, potentially leading to less investor protection.

- Higher Minimum Investments: Despite increasing accessibility, many still require significant capital commitments, making them out of reach for average retail investors.

Conclusion

The rise of alternative investments signifies a maturing and evolving financial landscape.

As investors continue to seek new avenues for growth, diversification, and inflation protection, alternatives are increasingly becoming an integral part of sophisticated portfolio construction.

However, their complexity, illiquidity, and often higher risk profiles demand a high level of due diligence, investor education, and professional guidance. While they offer exciting potential, they are not a one-size-fits-all solution.

For those willing to navigate their intricacies, alternative investments represent a new frontier, offering unique opportunities to enhance returns and fortify portfolios against the challenges of a dynamic global economy.