A loan’s terms are the specific conditions a borrower agrees to when taking on debt, and they are the primary determinants of the total cost of credit. The most significant of these terms is the loan’s duration, or tenure.

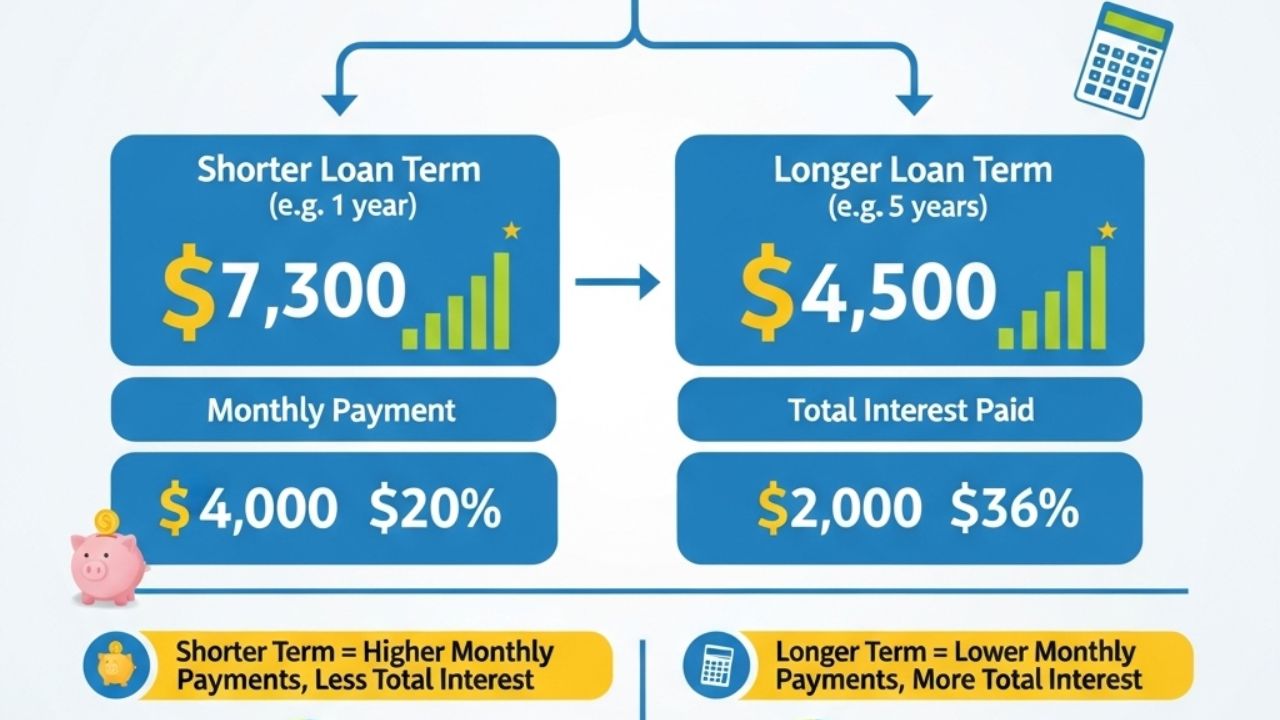

While a longer loan term may seem more appealing because it offers a lower monthly payment, it almost always leads to a higher total cost of borrowing due to the way interest is calculated and accrued over time.

Conversely, a shorter loan term results in higher monthly payments but a significantly lower total cost of credit.

Understanding how different loan terms and variables interact is crucial for making informed financial decisions and minimizing the overall expense of a loan.

The Core Components of Loan Cost

Before diving into how loan terms affect the cost of credit, it’s essential to understand the key components that make up that cost.

Principal

The principal is the original amount of money borrowed. It’s the foundation of the loan and is the amount you are obligated to repay in full.

Interest

Interest is the cost of borrowing the principal. It is the fee a lender charges for the use of their money, typically expressed as a percentage of the principal. This percentage, known as the interest rate, is a major factor in determining the total cost of a loan.

Annual Percentage Rate (APR)

While the interest rate is a critical component, it doesn’t always tell the whole story. The Annual Percentage Rate (APR) provides a more comprehensive measure of the cost of credit. It includes the interest rate plus any additional fees and charges, such as loan origination fees and prepayment penalties. By factoring in these extra costs, the APR offers a more accurate representation of the true annual cost of a loan, making it the best metric for comparing different loan offers.

The Relationship Between Loan Term and Total Cost of Credit

The most significant factor influencing the total cost of a loan is the loan term or tenure, which is the length of time over which you agree to repay the loan. The relationship is simple yet profound:

- Longer Loan Term: Higher total cost of credit, lower monthly payments.

- Shorter Loan Term: Lower total cost of credit, higher monthly payments.

This dynamic is best explained by the concept of compound interest and the loan amortization schedule.

The Amortization Effect

An amortization schedule is a table that breaks down each loan payment into its principal and interest components. In the early stages of a loan, a larger portion of each payment goes toward paying off the interest, while a smaller portion goes toward the principal. As the loan matures, this ratio shifts, with more of each payment allocated to the principal.

With a longer loan term, this process is stretched out. You’re paying down the interest on a large principal balance for a longer period. This allows more interest to accrue, significantly increasing the total amount you pay over the life of the loan.

Conversely, with a shorter loan term, you are paying off the principal more quickly. This means the interest is calculated on a smaller outstanding balance each month, leading to a much lower total interest payment by the time the loan is fully repaid.

Example: Imagine you borrow $100,000 for a mortgage at a 5% fixed interest rate.

- 20-Year Term: Your monthly payment would be higher, but you’d pay off the principal faster. The total interest paid over the life of the loan might be around $58,000.

- 30-Year Term: Your monthly payment would be lower, but the loan would last an extra ten years. The total interest paid could soar to over $93,000—a difference of over $35,000 just in interest.

Other Loan Terms that Affect the Cost of Credit

While the loan term is paramount, other conditions within the loan agreement can also influence the total cost of borrowing.

Interest Rate Type

The type of interest rate can dramatically affect your long-term cost, especially on long-term loans.

- Fixed-Rate Loans: The interest rate remains constant throughout the loan term. This provides predictability and stability, but you might pay a slightly higher initial rate for this certainty.

- Variable-Rate Loans: The interest rate can fluctuate over time based on a specific market index. These loans often start with a lower interest rate, which can be attractive. However, if market rates rise, your interest rate and monthly payments could increase, potentially leading to a much higher total cost over the life of the loan.

Loan Origination Fees

These are one-time fees charged by the lender for processing the loan application. They are typically expressed as a percentage of the loan amount (e.g., 1% of the principal).

These fees are part of the total cost of credit and are included in the APR calculation. A loan with a lower interest rate but a high origination fee might end up being more expensive than a loan with a slightly higher interest rate and no fees.

Prepayment Penalties

A prepayment penalty is a fee some lenders charge if you pay off the loan early. This penalty can make it more costly to refinance the loan or sell the asset before the term is complete. It’s a key term to look for, especially if you anticipate paying off the loan ahead of schedule.

Collateral Requirements

Loans can be either secured or unsecured. A secured loan requires an asset, such as a home or car, as collateral. Because the lender has a way to recover their money if you default, secured loans typically come with lower interest rates.

An unsecured loan, like a personal loan, doesn’t require collateral and is based on your creditworthiness. As a result, they carry more risk for the lender and often come with higher interest rates, increasing the overall cost of credit.

How to Choose the Right Loan Term

Selecting the right loan term is a balancing act between short-term affordability and long-term cost. Here are some key considerations:

- Analyze Your Budget: Can you comfortably afford the higher monthly payments of a shorter-term loan? If so, it’s almost always the more cost-effective option in the long run. If a longer term is the only way to make the payments fit your budget, the lower monthly payment may be worth the extra interest.

- Consider Your Financial Goals: Are you looking to pay off debt as quickly as possible to free up cash flow for other investments, or is your priority to keep monthly expenses low? Your financial goals should align with your loan term.

- Factor in Risk and Certainty: A fixed-rate loan with a predictable payment can provide peace of mind. A variable-rate loan might save you money if rates fall, but it exposes you to the risk of higher payments if rates rise.

- Use a Loan Calculator: Before committing to a loan, use an online loan calculator to compare different scenarios. Plug in various loan amounts, interest rates, and terms to see how they affect your monthly payment and total interest paid.

In conclusion, the loan term is the single most powerful factor in determining the total cost of credit. By choosing a shorter term, borrowers can save a substantial amount of money in interest, despite having to manage higher monthly payments.

A thorough understanding of all loan terms—including interest rates, APR, fees, and penalties—empowers consumers to make financially savvy decisions that align with their personal budgets and long-term goals